This post-pandemic year, as financial institutions focus more on innovation and growth in emerging technologies, Robo advisory in India is experiencing unprecedented growth.

“Harness the power!” of Robo Advisor. Empower your customers!

The fintech sector is undergoing rapid evolution, and today’s retail investors crave unbiased, uninterrupted, and unambiguous financial advice. To cater to these needs, along with others such as cost efficiency, agility, user experience, and minimum human intervention, Robo-advisor or a Robo advisory platform is the new favourite of digitally savvy investors and financial planning experts.

Robo Advisory is in DINTW’s List of Digital Marketing Trends for 2023, along with Instagram Reels, Voice Search, Content Atomization and People Marketing.

What is “Robo advising”?

Robo-advisory is a type of automated financial advice provided online without the involvement of a human advisor. According to Wikipedia, “Robo-advisory” encompasses various automated financial services, including financial advice and investment management. These web-based marketplaces facilitate automated investment called Robo investing and management by applying for algorithms and computer programmes. Robo advisory service doesn’t replace the need for a financial advisor. Perhaps it empowers him to offer a more precise investment strategy.

What does Robo Advisor do?

Robo advisory services use algorithms to create and implement investment portfolios that typically include stocks, bonds, mutual funds, ETFs (exchange-traded funds), index funds, real estate, or other alternative or direct investment products. Robo advisory makes portfolio suggestions based on a client’s financial profile and risk appetite. A traditional advisor isn’t needed to develop a complete investment plan.

What is the Robo Advisor service?

Robo advisers are a fantastic opportunity for portfolio and investment advisors to provide their customers with more safety, efficiency, and openness, thanks to the rapid development of technology. An automated financial advisor, or Robo advisor, may help you build a portfolio that considers your risk tolerance and long-term financial goals. As a result, the standard financial planner is relieved of creating an exhaustive investing strategy.

What are the different types of Robo advisory services?

One type of Robo advisor is a “full-service” one, which offers assistance with every aspect of investing and asset allocation for a retail investor. It can make investment recommendations, assume responsibility for asset management, and rebalance existing portfolios. A half-service Robo advisor can only make product recommendations when developing investment strategies. A self-service Robo advisor is an online service that provides private investors with investment advice.

Why should you use Robo advisors in fintech?

In most cases, people seek the advice of a financial planner or advisor before making any significant financial investments or choices. However, financial advisors may provide inaccurate or biased advice, and their services may come with hefty fees. More importantly, in the modern era, we favour completing various tasks in the virtual realm. Therefore, it is only natural to turn to Robo advisors for financial planning needs. Both baby boomers and millennials, who fall somewhere in the middle of the “Do-it-for-me” and “Do-it-yourself” camps, can benefit from the rise of Robo advisors in the financial technology industry. Robo-advisors, or automated financial planning software, have several advantages over human, financial advisors.

Robo advisory is the way forward for fintech firms and is applicable across functions. Following are the use cases with case studies from brands around the world.

Customer onboarding

Charles Schwab, a 40-year-old financial services company in the US, clocked the lowest customer onboarding time via an automated and simplified sign-up process using Robo Advisory. This time, onboarding was precise and error-free. Similarly, Future Advisor and Betterment enable their clients to open a discretionary account in less than five minutes and move money into new accounts in under five clicks. While clients sign up quickly, firms onboard more clients faster and operate at the same scale with reduced manpower.

Economic Rewards

By attracting a greater number of smaller accounts (usually the gen z investors who have just started investing), robo advisors generate the same revenue as expensive advisors and are more profitable. Zerodha is an excellent example of the best Robo advisor in India. Portfolio rebalancing facilitated by Robo advisors is practically free. Rebalancing based on an algorithm makes tax loss harvesting economically feasible. In addition, you collect more information about the user through an omnichannel data practice. This data can be used to identify behavioural patterns that can improve user engagement and satisfaction, thereby increasing a Robo advisory firm’s profitability. Lastly, algorithmic portfolio rebalancing can rapidly adjust portfolios in response to shifting market conditions, allowing users to maximise returns while minimising risk.

Client-Centric Approach

Betterment, a fintech company, relies heavily on Robo Advisory and provides a user-friendly interface with plenty of educational resources. Wealthfront and Fidelity Go offer total control to their users and comprehensive wealth advisory. A better customer experience is provided by effectiveness, openness, affordability, accessibility around the clock, a low minimum balance, low taxes, and regular rebalancing. Thanks to dashboard displays, investors can add or withdraw money anytime. This enables FinTech companies to reach a wider audience and build enduring client relationships. These features make it easier for investors to manage their money and portfolios with minimal effort.

High-precision Features

Robo advisers create personalised portfolios using detailed questionnaires to gather vital information such as personal characteristics and financial objectives. E*TRADE, Merrill Edge, and Schwab offer investors individualised finance evaluations, risk tolerances, investment strategies, wealth management advice, and service recommendations through their most thorough questionnaires. Additionally, robo advisors allow customers to track their portfolios and watchlists, get notified of relevant events or developments in the market, and buy or sell stocks and funds from within the application. The automated investment advisor helps reduce human financial advisors’ unforced errors and inherent bias.

Everywhere Automation

Investment decisions are made by algorithms based on market investigation and analysis. This entails impartial guidance with little human involvement based on the investor’s financial goal. Betterment offers an automated Tax-Loss harvesting feature and a highly diversified portfolio management, whereas Schwab offers an entirely automated insurance sales cycle, underwriting, policy management, and claims process. This automated approach to investing and insurance sales is becoming increasingly popular as it removes the element of human bias from investment adviser decisions and ensures that customers receive unbiased guidance from algorithms.

DINTW has pioneered marketing automation across small and medium enterprises across Asia and the Americas. Here is our list of 19 Must-Have Features of Marketing Automation.

Conclusion

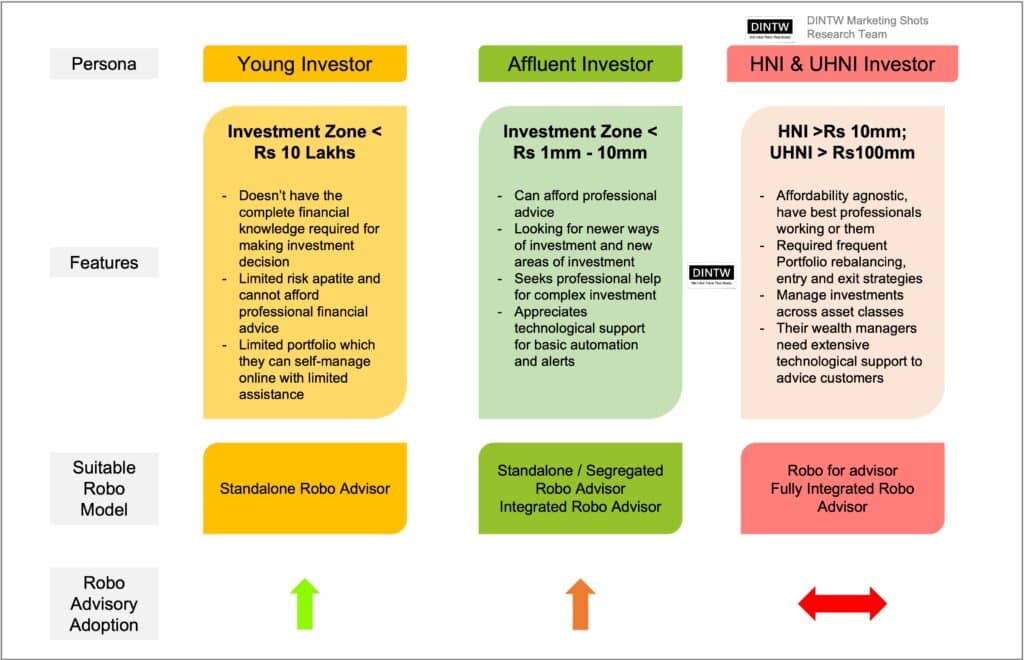

Robo-advisors have reached a turning point since their inception more than a decade ago. The incumbents have rapidly adopted Robo advisory models using their existing clientele to scale their offerings. Traditional wealth managers and independent advisors will use Robo advisory models more frequently to serve the affluent segment of the market. Independent robo advisors are at a crossroads where they must decide whether they want to expand by innovating product offerings and forming market partnerships or whether they want to be acquired by larger firms to help bridge market gaps. But one thing is sure: Robo advisory in India is rising, and more innovation will occur in this sector.

Meet DINTW

DINTW is a consulting firm and digital agency specialising in mapping user journeys and consumer behaviour across marketing automation, process automation, chatbots, and other human-to-machine interaction tools. DINTW is at the cutting edge of the fintech industry because of the innovative ways it assists companies in optimising their customers’ journeys and creating targeted marketing strategies. We welcome the opportunity to discuss your business needs and create compelling and relevant user journeys.

The post Robo advisory in India: The Next Frontier for Scaling Businesses appeared first on DINTW Digital Marketing Shots.